SaaS software programs are often available at a subscription rate to users. Just a few examples of this type of service are ClickUp, QuickBooks, and Adobe. They can provide access to the program while lowering your total cost. Here you will see various SAAS statistics for general understanding.

The key reasons SaaS is so popular are its flexibility, accessibility, scalability, security, and consistency. Besides these seven qualities that SaaS offers enterprise companies, there's also increased collaboration with it.

Contents

- 1 Benefits of SaaS for Businesses

- 2 Challenges and Risks of SaaS Adoption

- 3 SaaS vs. On-Premise Software: A Comparative Analysis

- 4 Important SaaS Statistics

- 5 Market Growth of SaaS Businesses

- 6 Overview Of Saas Market Revenue and Pricing Models

- 7 AI Involvement in SaaS

- 8 Future of SaaS: Predictions for the Next Decade

- 9 FAQs About SaaS

The Evolution of SaaS

The concept of SaaS has roots in the 1960s, when mainframe computers were used to offer time-sharing services. However, it wasn’t until the late 1990s and early 2000s that SaaS began to take its modern form. Companies like Salesforce, launched in 1999, pioneered the SaaS model with cloud-based customer relationship management (CRM) solutions.

As internet speeds improved and cloud infrastructure became more reliable, SaaS adoption skyrocketed. Businesses began to see the advantages of lower upfront costs, easier scalability, and enhanced accessibility. By the 2010s, SaaS had transformed from a niche offering into a dominant model for software delivery across industries.

Today, SaaS continues to evolve with the integration of artificial intelligence, machine learning, and advanced data analytics. As businesses look for more agile and efficient software solutions, SaaS is positioned to remain at the forefront of digital transformation for years to come.

Benefits of SaaS for Businesses

SaaS (Software as a Service) offers transformative advantages that cater to businesses of all sizes. Understanding these benefits through key SaaS statistics and industry insights can help decision-makers make informed choices.

Cost-effectiveness: SaaS solutions typically require lower upfront investments compared to traditional software. Businesses don’t have to purchase expensive hardware or software licenses, and the subscription-based pricing model allows for predictable monthly expenses. According to SaaS industry statistics, this cost-efficiency is one of the leading drivers behind SaaS adoption, especially for small and medium-sized enterprises (SMEs).

Accessibility: One of the most compelling advantages of SaaS is its cloud-based nature. Users can access applications from anywhere with an internet connection, making remote work and global collaboration more seamless. SaaS stats reveal that over 70% of businesses choose SaaS solutions primarily for their accessibility, ensuring teams stay connected regardless of location.

Automatic Updates: Traditional software often requires time-consuming manual upgrades, which can lead to operational disruptions. SaaS solutions handle updates automatically, ensuring businesses always have access to the latest features and security patches. SaaS marketing statistics highlight that companies using SaaS experience 25% fewer software-related downtimes due to this automatic update functionality.

Customization: SaaS platforms offer flexible solutions that can be tailored to meet the specific needs of various industries. Whether a business is in healthcare, finance, or retail, SaaS providers offer modular options and APIs for seamless customization. According to SaaS statistics, over 60% of businesses rely on customizable SaaS tools to enhance operational efficiency and customer experience.

By leveraging the benefits of SaaS, businesses can streamline processes, reduce costs, and maintain operational agility in today’s dynamic landscape.

Challenges and Risks of SaaS Adoption

While SaaS provides numerous benefits, businesses must be aware of potential challenges and risks. SaaS adoption statistics show that many companies face hurdles that can impact the success of their transition.

Data Security Concerns: One of the most cited risks in SaaS industry statistics is data security. With sensitive business data stored in the cloud, companies are vulnerable to breaches and unauthorized access. SaaS providers often implement robust security measures, but businesses must still conduct due diligence and adopt additional safeguards.

Dependency on Internet Connectivity: SaaS relies heavily on stable Internet connections. Businesses in regions with unreliable connectivity may experience frequent disruptions. SaaS stats indicate that nearly 40% of companies report performance issues due to connectivity problems, making this a critical consideration for potential adopters.

Vendor Lock-in Risks: Switching SaaS providers can be challenging due to data migration complexities and contractual obligations. SaaS marketing statistics suggest that businesses often underestimate vendor lock-in risks, which can limit future flexibility and increase costs over time.

Compliance and Regulatory Issues: Companies operating in highly regulated industries, such as healthcare or finance, must ensure their SaaS solutions comply with relevant regulations. Non-compliance can lead to fines or legal issues. SaaS industry statistics show that nearly 30% of businesses encounter compliance challenges when adopting cloud-based solutions.

Despite these challenges, businesses can mitigate risks with thorough planning and by partnering with reputable SaaS providers. Awareness of these potential hurdles allows companies to fully reap the benefits of SaaS while safeguarding their operations and data integrity.

SaaS vs. On-Premise Software: A Comparative Analysis

The ongoing debate between SaaS (Software as a Service) and on-premise software continues to shape business decisions worldwide. Both options have their merits, but SaaS solutions are rapidly gaining favor due to their flexibility and cost-effectiveness. Let’s break down the key factors in this comparative analysis.

Cost Comparison

One of the most significant distinctions lies in the upfront costs. On-premise software often requires a substantial initial investment for hardware, licenses, and installation. SaaS, on the other hand, operates on a subscription model, spreading out costs over time. This lowers the barrier to entry and reduces financial risk. Furthermore, SaaS providers typically bundle maintenance and updates into their subscription fees, offering better predictability in spending. According to SaaS market statistics, businesses are seeing consistent savings with cloud-based solutions over traditional software.

Scalability and Flexibility

SaaS solutions excel in scalability. Businesses can easily add or remove users and features as their needs evolve. This is particularly beneficial for companies experiencing rapid growth or seasonal fluctuations. In contrast, scaling on-premise software can be costly and time-consuming due to physical hardware limitations and licensing complexities. SaaS industry growth rate data shows that companies prioritizing agility are overwhelmingly opting for SaaS over on-premise alternatives.

Maintenance and Support

With on-premise software, maintenance responsibilities fall squarely on the company’s IT department. This includes installing updates, troubleshooting, and managing hardware issues. SaaS solutions, however, offer automatic updates and dedicated support teams, reducing the burden on internal staff. These features not only improve efficiency but also ensure access to the latest software capabilities. SaaS growth statistics highlight that businesses adopting SaaS are more likely to report higher satisfaction with vendor support.

Long-Term ROI

While on-premise software may seem cost-effective in the long run, the hidden costs of maintenance, upgrades, and potential downtime often erode that advantage. SaaS’s pay-as-you-go model ensures businesses only pay for what they need, with the added benefit of quicker implementation and faster time to value. Additionally, SaaS spending by industry continues to grow, demonstrating that more sectors recognise cloud-based solutions' long-term ROI potential.

Key Industries Leveraging SaaS Solutions

SaaS solutions have become essential across numerous industries, offering tailored tools to meet sector-specific needs. Here’s how key industries are leveraging SaaS to drive efficiency and innovation.

Healthcare: Telemedicine and Patient Management Systems

The healthcare industry has embraced SaaS solutions to enhance patient care and streamline operations. Telemedicine platforms powered by SaaS allow patients to consult doctors remotely, increasing accessibility and reducing wait times. Additionally, cloud-based patient management systems improve data sharing among healthcare providers while ensuring compliance with stringent privacy regulations. SaaS market statistics reveal that the healthcare sector’s SaaS adoption has grown exponentially in recent years.

Finance: Accounting and Financial Planning Tools

SaaS platforms offer robust solutions for financial planning, budgeting, and accounting. These tools provide real-time financial insights, helping businesses make data-driven decisions. Additionally, cloud-based platforms improve collaboration by enabling multiple stakeholders to access financial data simultaneously. With SaaS industry growth rate data showing increased adoption, financial institutions are leveraging these tools to enhance operational efficiency and regulatory compliance.

Education: Learning Management Systems (LMS)

Educational institutions are turning to SaaS-based learning management systems to deliver courses and manage student progress online. These platforms offer flexibility for both students and educators, supporting hybrid and fully remote learning models. LMS solutions also provide analytics to track engagement and performance, helping institutions improve learning outcomes. SaaS growth statistics indicate that the education sector is one of the fastest-growing adopters of SaaS solutions.

Retail: E-Commerce Platforms and Inventory Management

Retailers are using SaaS solutions to power e-commerce websites, manage inventory, and optimize customer experiences. Cloud-based platforms provide real-time inventory updates, automated order processing, and personalized marketing tools. These capabilities help retailers stay competitive in a rapidly evolving market. SaaS spend by industry data confirms that the retail sector’s investment in SaaS solutions continues to climb as businesses prioritize agility and customer satisfaction.

SaaS solutions are driving innovation across industries, offering flexible, cost-effective, and scalable tools that meet diverse business needs. As adoption rates soar, it’s clear that SaaS is shaping the future of enterprise technology.

For these reasons, the SaaS market has been booming in recent years and is expected to grow even more in the coming years. The amount that companies are paying on average per application has steadily risen each year and it's forecasted that this growth will continue.

Larger companies tend to take advantage of more SaaS apps and custom software than SMBs do. In general, organizations that have over 1,000 employees use an average of 171+ SaaS applications. A study by Gartner shows that nearly 50% of all companies using more than one SaaSe product will centralize their management of them within the next five years. This is a trend that is expected to continue as businesses are looking for ways to increase their productivity and reduce costs.

Should SaaS be the future of business? Many people seem to think so. It also seems inevitable considering how many people experienced working from home during the pandemic. Many business owners and managers have realized the importance of SaaS within their company and employees now work more efficiently and collaboratively through it.

There are so many new SaaS companies coming out, which is both a good and a bad thing. It’s great because it means there’s so much innovation happening. But as you know, with all this innovation also come strong competition which might end up squashing some interesting startups. We should also be wary of the risks behind using SaaS. Organizations must work with their employees on how to use it properly so they're aware of any potential risks. And they also need to make sure third party SaaS products are approved by their IT departments, otherwise, sometime it becomes difficult to maintain the safety of their employees, customers and data.

| Overview | - (SaaS) estimated market is approximately worth 152$ billion | ||

| - 208$ billion by 2023 | |||

| Organizations with more than 1,000 employees use 170+ SaaS applications | |||

| SaaS apps account for 70% of all business software usage. | |||

| There is a tenfold increase in SaaS apps since 2015, and by 2025 it is expected that 85% of business apps will be SaaS-based. | |||

| 50% of businesses will centralise SaaS application management by 2026. | |||

| Most prominent companies in the SaaS market are Microsoft, Salesforce, Oracle, SAP, and Google. | |||

| SaaS growth in key markets | 1 | US, UK, Canada, and Germany have the most SaaS companies in the world | |

| 1.1 | Only 2% of UK businesses are not on the cloud | ||

| 1.2 | 26% of the EU is using the cloud. | ||

| 2 | Region | # of companies | |

| US | 17000 | ||

| UK | 2000 | ||

| Canada | 2000 | ||

| Germany | 1000 | ||

| France | 1000 | ||

| 3 | SaaS, is the main startup model in Brazil and it makes up 41.12% of Brazilian startup | ||

| Stats on SaaS pricing | 38% of SaaS companies only charge clients when they actually use the service or product. | ||

| In 50% of SaaS businesses, consumers are charged based on the number of users. | |||

| 31% of SaaS businesses, they rarely give discounts. | |||

| 30 days is the most common free trial period. | |||

| More than 50,000 SaaS companies give their clients discounts of at least 30%. | |||

| usage of SaaS | 94% of the 786 technical professionals in small and big enterprises use cloud SaaS. | ||

| in 2017, 86% of data centre workloads were performed in the cloud; by 2021, this percentage had increased to 94%. | |||

| Companies use an average of 34 SaaS apps. | |||

| 50% of US government organizations are now using the cloud. | |||

| SaaS popularity in businesses | Enterprise businesses see themselves as "intermediate" or "advanced" level user in 68% of cases. | ||

| 16% of business organisations are in the beginning stages. | |||

| 12% of companies are taking a look at what the digital industry has to offer but haven't yet taken the plunge into participating or educating themselves about it. | |||

| 12% of a business’s SaaS budget is for operating systems. | |||

| 10% of a business’s SaaS budget is for productivity | |||

| SaaS attraction Factor | Agility and scalability: | 70% of CIOs are drawn to cloud-based software applications for their flexibility and the ability to grow with the company. | |

| Disaster recovery: | 38% of companies are now using cloud-based systems that allow for more improved disaster recovery. | ||

| Flexibility: | 37% of companies are adopting cloud-based systems because they offer flexibility. | ||

| Sales and Marketing Trends for SaaS | 48% of companies have an average of one-year SaaS contracts. | ||

| 13% of businesses use SaaS products on a monthly basis. | |||

| SaaS contracts with lengths of three years or longer are used by 11% of businesses. | |||

| The biggest SaaS businesses have blogs in 85% of cases. | |||

| Top SaaS firms with podcasts account for 18% of the market. | |||

| 36% of SaaS businesses share educational materials on their blogs. | |||

| For SaaS businesses from other regions, North America continues to be a significant market.The software market in North America is the most developed. | |||

| SaaS Trends | Use of AI | ||

| Vertical SaaS | |||

| Integration Capabilities | |||

| Re-disruptors |

Important SaaS Statistics

Everything is changing in business due to SaaS or Software as a Service. Here are a few relevant SaaS statistics that speak for themselves about how influential it is:

- By the end of 2024, the worldwide SaaS in numbers is going to hit almost $317.55 billion. In 2023, SaaS market was around $273.55 billion. This shows that SaaS solutions are going to stay for long with high demand of consumers.

- In next few years, it is predicted that SaaS market may touch $1.23 trillion. Since every other day a new business is forming, the need for SaaS softwares is on its peak.

- A total of 92% of business leaders are planning to buy AI-powered software in 2024. That makes up a huge interest in using smart technology in everyday work

- 73% of Saas companies have reported that they put most of their time on manual planning for their budget. That is an open need for easier tools for these tasks

- For 2024, the top priorities for SaaS buyers are investing in new technology to improve productivity which is 52%, and enhance security is about 47%. Both are critical competencies today

- Almost 90% of the IT experts believe automation is important for handling SaaS operations. However, 64% indicate that they do not have enough resources for effective automation

- Spending by SaaS end-users is likely to surge to $679 billion in 2023. All public cloud services could eventually surpass $1 trillion by 2027. This SaaS stats is proving how SaaS becomes indispensable for common business activities.

Market Growth of SaaS Businesses

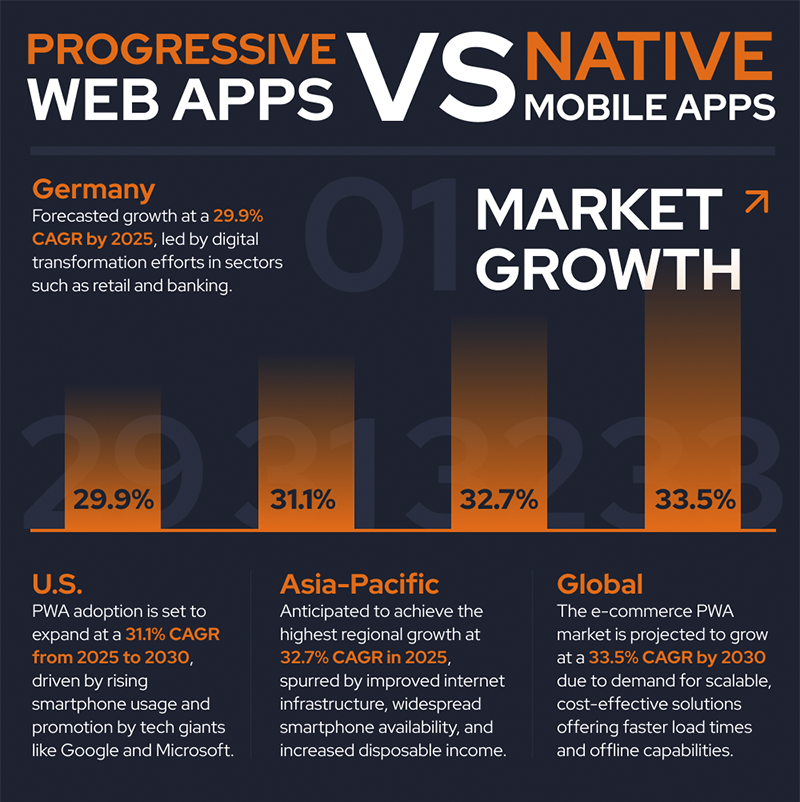

The SaaS or Software as a Service market has actually picked up pretty well. Since this market is expected to grow by an impressive 349% in the next ten years, it suggests just how many businesses select this cloud-based software to meet their needs. As per the SaaS statistics, North America alone accounted for 48% of the overall SaaS pie in 2023-a share of over $131.18 billion. While the U.S. leads the charge for most SaaS companies, which is over 17,000 !. U.S is a big player in that industry where Microsoft is alone valued at nearly $2.3 trillion.

As per the latest SaaS facts, experts project the global SaaS market to register a compound annual growth rate of 18.4% from 2024 to 2032. They expect the Asia Pacific region, which is among the fastest-growing, to post around 22% per annum. This goes to say that there will be increased adoption of SaaS solutions by more businesses in the region. More than 50% of large companies are expected to leverage specialized cloud platforms by 2028. The new research which is conducted some time ago indicates that 60% of businesses plan to increase spending on software more than last year.

Among the public SaaS companies, the median growth rate was at 35% as of the cutoff date for March 2023. The growth rate was the same for companies with investors while it was 32% among self-funded businesses. Moreover, private SaaS B2B companies with less than $1M of ARR reported the highest median growth rate at 50%. B2B private SaaS companies with $20M+ in ARR reported the worst growth rate at 27%.

These SaaS statistics prove the strength of SaaS business growth that will continue rising. Since many companies invest more in this market, it is clear that SaaS is taking its vital role in how businesses work.

Overview Of Saas Market Revenue and Pricing Models

SaaS Market Revenue

- The growth rates of SaaS companies have not only changed but have also gone down lately. The Compound Annual Growth Rate for them dropped down to 8.4% in September 2023; that was the lowest value since early 2022 when they had grown at a CAGR of 60%.

- The European SaaS market would garner a revenue of $69.82 billion by 2024.

- SaaS contributes to more than 60% of the world total revenue, attributed to large enterprises with more than 1,000 employees, in 2022. This shows that large companies have a very high dependence on SaaS solution.

- Private cloud companies dominated the source of the revenue, accounting for 43% of the total market share of SaaS market in 2022 and lead other segments in the market.

- Public SaaS companies tend to have a huge number of customers for an average of 36,000 in every company.

- Private SaaS companies have a net revenue retention rate of 102%. That means these companies could hold and grow their customers.

- By 2023, a total of 836 software companies in the world have valuations over a billion dollars. This is one of the surging values in the SaaS market.

- The median ARR per employee at private SaaS firms for 2023 reaches $112,500. Companies with more than $20 million in ARR-reach a relatively higher median ARR per employee at $183,932.

- On the lower side, the smallest SaaS companies with an ARR of less than $1 million reported a very low median ARR per employee which is valued at $55,183.

SaaS Pricing Models

SaaS companies adopt various pricing strategies to meet market demands. Here’s a breakdown of Saas statistics of common pricing models used in the industry:

|

Pricing Strategy |

Percentage of Companies Using It |

Key Insights |

|

Value-based pricing |

39% |

Companies set prices based on the value their software delivers to customers. This approach leverages the flexibility SaaS solutions offer. |

|

Competitor-based pricing |

24% |

Some SaaS companies choose to match their competitors' prices, following market trends. |

|

Published pricing structure |

45% |

Nearly half of SaaS companies publicly share their pricing details, making it easier for customers to understand costs upfront. |

|

Hidden pricing structure |

55% |

Slightly more than half keep their pricing confidential, often requiring potential clients to engage with sales teams. |

|

Discounting |

68% |

The majority of companies offer discounts in fewer than 25% of deals, while 29% admit that they rarely discount their pricing. |

|

Price increases |

73% |

Between August 2022 and August 2023, most SaaS providers raised their prices by an average of 12%. |

AI Involvement in SaaS

Artificial Intelligence (AI) is playing a big role in the world of Software as a Service (SaaS). Here’s how AI is impacting the SaaS market:

|

Market Growth |

The global AI software market reached $16.98 billion in 2024. It’s expected to grow to $80.6 billion by 2031, with a CAGR of 29.64%. This shows how rapidly AI is expanding in the tech space. |

|

Investment Surge |

By 2025, private investments in AI ventures are expected to hit $200 billion globally, with $100 billion of that in the U.S. This highlights the increasing interest and belief in AI’s potential. |

|

Revenue Growth for AI Data Services |

Revenue from AI data services, specifically for Machine Learning Operations tools, is predicted to almost quadruple from 2024 to 2028. This indicates a growing need for advanced data services in SaaS applications. |

|

Compliance Improvement |

By 2028, generative AI is expected to reduce the risk of noncompliance in software and cloud contracts by 30%. This is significant for businesses that rely on SaaS solutions, as compliance is crucial. |

Future of SaaS: Predictions for the Next Decade

The SaaS industry is constantly evolving, and its future is set to revolutionize the digital landscape. Let's explore the major trends shaping SaaS over the next decade.

Growth of AI-driven SaaS tools: Artificial Intelligence is already embedded in many SaaS applications, but its role is expected to grow exponentially. AI-driven SaaS solutions will enhance automation, data analytics, and customer experiences. From predictive analytics to chatbots and intelligent workflows, these advancements will optimize business processes across industries. Companies leveraging AI-based SaaS compound management solutions will see streamlined operations and reduced human error.

Increased adoption in emerging markets: As internet connectivity expands and businesses digitize, emerging markets are expected to drive significant SaaS usage. Businesses in the UAE, for instance, are adopting new marketing strategies for SaaS businesses in the UAE to cater to their growing tech-savvy populations. Increased cloud infrastructure investments will enable small businesses in these markets to access affordable, scalable SaaS solutions, boosting global SaaS industry adoption rates.

The role of SaaS in remote work and hybrid work models: The shift to remote and hybrid work has accelerated SaaS usage statistics, and this trend is here to stay. Collaboration and project management tools will become increasingly essential for ensuring seamless communication across distributed teams. SaaS platforms will also prioritize enhanced security measures to safeguard sensitive company data across remote work environments.

FAQs About SaaS

What is the average cost of SaaS software?

SaaS pricing varies greatly depending on the service type and business size. On average, businesses spend anywhere from $20 to $500 per user per month. SaaS spending by industry also impacts costs—industries like healthcare and finance may require more specialized, high-security features, driving up the price.

How secure is SaaS compared to traditional software?

SaaS providers invest heavily in cloud-based security measures, including encryption, firewalls, and multi-factor authentication. However, businesses must vet providers to ensure compliance with industry standards. Companies in finance often turn to SaaS compound management tools to ensure compliance and data protection.

Can SaaS be customized for small businesses?

Yes, most SaaS providers offer customizable options for small businesses. They can tailor features and integrations to meet specific needs, ensuring high flexibility and scalability.

What happens if a SaaS provider goes out of business?

SaaS providers are contractually obligated to safeguard customer data. Many vendors offer data export options or transition plans to protect clients. It's critical to check service-level agreements (SLAs) for details before signing any SaaS contracts.